Medicare Advantage Agent Can Be Fun For Anyone

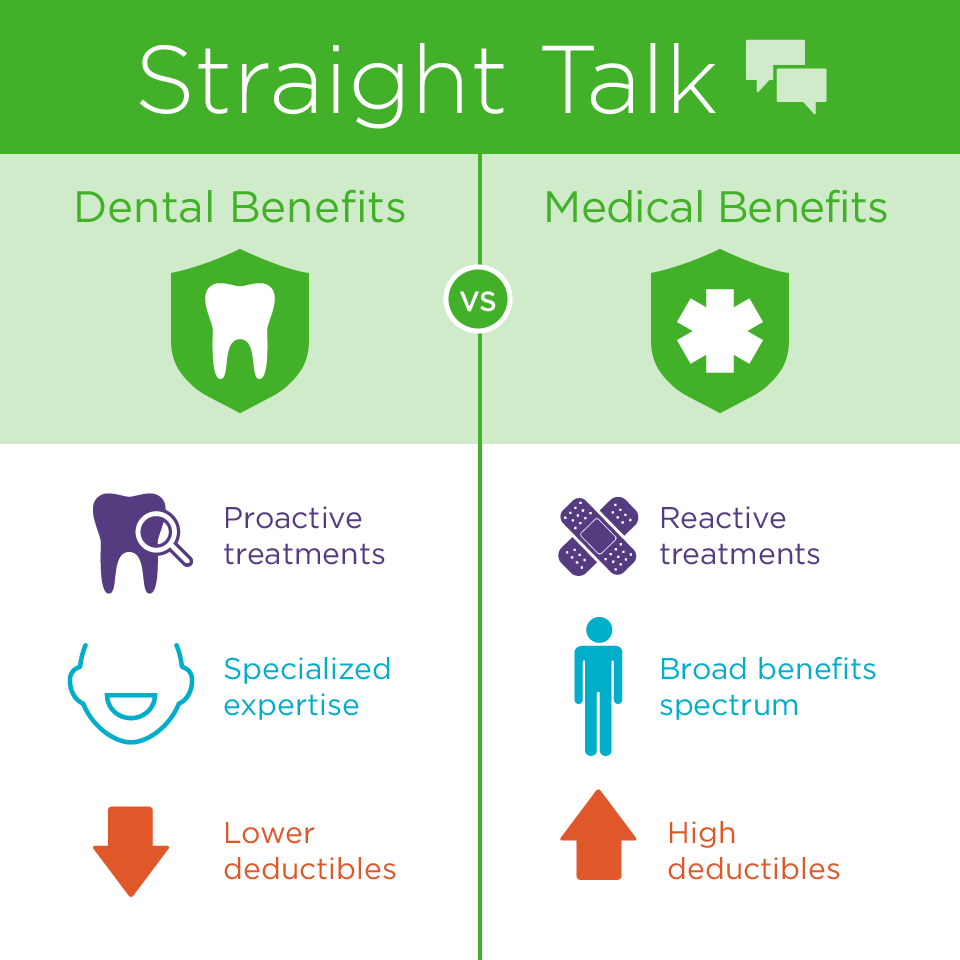

You can use this period to sign up with the plan if you didn't previously. Plans with higher deductibles, copayments, and coinsurance have reduced premiums.

Call the market to learn more. If you buy from an unlicensed insurer, your case can go unpaid if the company goes broke. Call our Customer service or visit our site to inspect whether a business or agent has a license. Know what each plan covers. If you have physicians you wish to keep, make sure they're in the plan's network.

The Medicare Advantage Agent Statements

Make sure your drugs are on the strategy's list of accepted drugs. A strategy won't pay for medicines that aren't on its listing.

The Texas Life and Health Insurance coverage Warranty Association pays claims for health and wellness insurance. It doesn't pay claims for HMOs and some various other kinds of strategies.

Your spouse and kids additionally can proceed their protection if you go on Medicare, you and your spouse separation, or you die. They should have gotten on your strategy for one year or be more youthful than 1 years of age. Their coverage will end if they get various other protection, do not pay the costs, or your company quits offering health insurance coverage.

Not known Details About Medicare Advantage Agent

You should tell your employer in creating that you desire it. If you continue your coverage under COBRA, you have to pay the costs on your own. Your employer does not need to pay any of your costs. Your COBRA insurance coverage will coincide as the coverage you had with your company's plan.

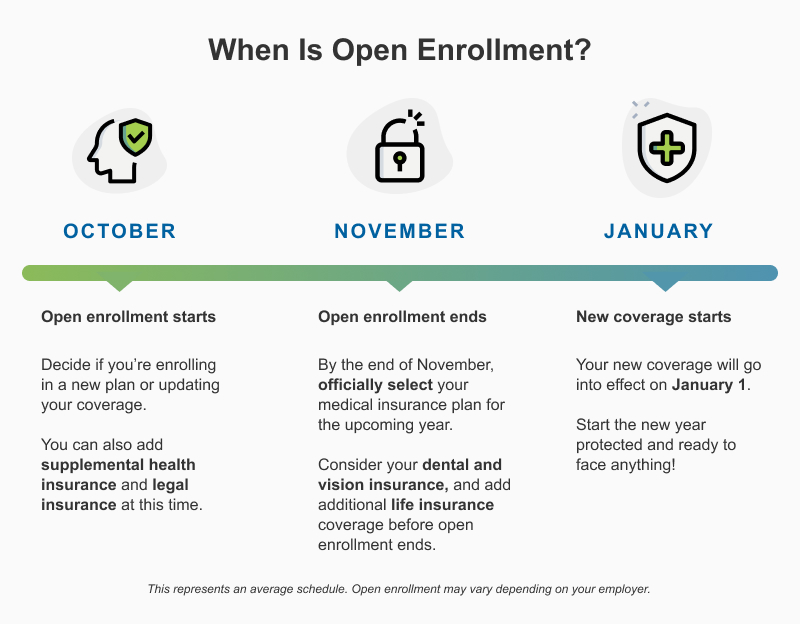

When you have registered in a health insurance plan, make sure you understand your strategy and the price ramifications of different procedures and services. For instance, mosting likely to an out-of-network physician versus in-network typically costs a customer far more for the very same type of solution. When you enlist you will be given a certification or evidence of coverage

Some Ideas on Medicare Advantage Agent You Need To Know

It will likewise inform you if any type of services have limitations (such as maximum amount that the health and wellness plan will spend for sturdy medical devices or physical treatment). And it should tell what solutions are not covered at all (such as acupuncture). Do your homework, study all the options offered, and review your insurance coverage prior to making any kind of choices.

Some Known Facts About Medicare Advantage Agent.

When you have a clinical treatment or go to, you normally pay content your health care provider (physician, health center, therapist, etc) a co-pay, co-insurance, and/or a deductible to cover your part of the supplier's bill. You expect your health and wellness strategy to pay the remainder of the costs if you are seeing an in-network provider.

However, there Homepage are some situations when you could need to submit a case on your own. This could happen when you go to an out-of-network provider, when the supplier does decline your insurance, or when you right here are traveling. If you need to submit your very own wellness insurance claim, call the number on your insurance card, and the customer assistance rep can educate you exactly how to submit a case.

Lots of health insurance plan have a time limitation for the length of time you have to submit a case, commonly within 90 days of the solution. After you submit the claim, the health insurance has a limited time (it differs per state) to notify you or your company if the health and wellness plan has actually approved or refuted the insurance claim.

The Greatest Guide To Medicare Advantage Agent

If it determines that a solution is not medically necessary, the plan might deny or minimize settlements. For some health insurance, this medical necessity choice is made before therapy. For other health insurance, the choice is made when the company gets a costs from the service provider. The firm will send you a description of advantages that describes the solution, the amount paid, and any kind of additional amount for which you might still be responsible.